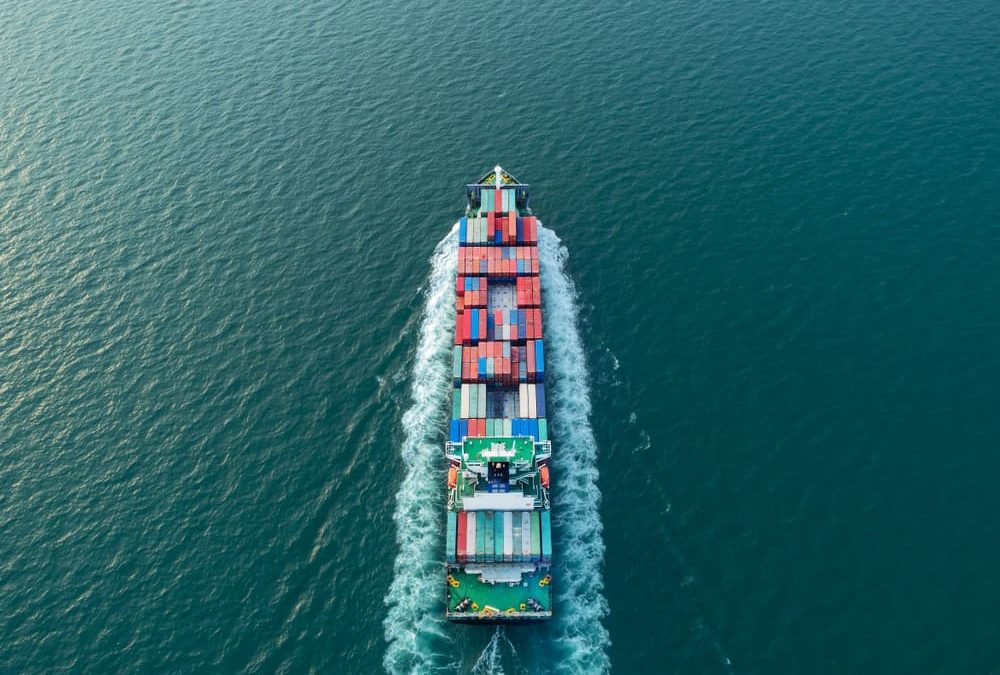

The trade is finally hearing some good news about the coronavirus and global supply chains: Cargo volumes and ship calls have swiftly rebounded at Chinese ports, confirming that the cogs of global trade are grinding back into motion. The caveat is that this was to be expected as Chinese port workers and truckers returned after an extended Chinese New Year (CNY) holiday. Inbound and outbound cargo delayed during the post-CNY period was already en route or contracted for transport.

The question ahead, is whether volumes will sink back again if there are manufacturing disruptions and reduced demand, or alternatively, whether volumes will increase if China pursues a stimulus program. Analysts have released data showing that both import and export cargo flows (measured in terms of the mass transferred on and off ships) have reverted to historical norms. The bottom for Chinese imports and exports across almost all shipping sectors was on Feb. 15. On the import side, the decline prior to that date was driven by dry bulk. Since then, analysts say, “dry bulk has mostly recovered, energy has completely recovered and container imports may be higher than they were before Chinese New Year,” with imports overall recovering “less than a week” after the low was hit.

On the export front, Chinese declines through Feb. 15 were driven by the container sector. Since then, cargo categories including containers have rebounded. “The recovery in exports was a little slower to materialize but exports did return to the seasonally expected range by the end of the month [February],” said analysts.

Analysis Aside, Capacity and Equipment Concerns Remain

Terminal operators at the ports of Los Angeles and Long Beach are canceling dozens of work shifts due to plunging cargo volumes, which is making it increasingly difficult for shippers and truckers to return empty containers.

With trans-Pacific carriers continuing to blank sailings as cargo volumes drop, the inability to return empty containers to the terminals is expected soon to result in a shortage of chassis in Southern California. The backlog of empty containers at marine terminals, warehouses, and trucker yards is escalating by the day, and chassis shortages could develop because the vast majority of idled empty containers are sitting on chassis, effectively taking that equipment out of service for days on end.

Some terminals began notifying clients they would only issue appointments for the return of empty containers to truckers that were also taking delivery of full containers coming off of ships. Some terminals then began to refuse returns of all empty containers saying this action was taken because the blank sailings have significantly reduced the outbound vessel capacity needed to return the empties to Asia, and they simply do not have enough space to handle thousands of empty containers with nowhere to go.

Ocean Carriers Continue to Cut Capacity

Total capacity for the Far East/US West Coast sectors will decrease in 2020, with five routes removed permanently in March and April. However, two new liner services are being introduced under the Alliance networks due to launch on April 1. The significant shift will be with Hyundai Merchant Marine (HMM) from the 2M Alliance to THE Alliance. Analysts project that by May overall capacity will be reduced by 7,000 TEU. Capacity will be reduced 2.3% over levels of one year ago.

Scheduled capacity reductions are:

- As stated above, HMM will terminate three U.S. West Coast (USWC) strings by end March replacing these with services under the carrier’s new membership in THE Alliance.

- COSCO and Wan Hai will withdraw one of their joint-operated VSA services in early March, while their partner, PIL, is to withdraw entirely from the Trans-Pacific market.

- SM Line will replace one of its two USWC strings in early April with a new VSA arrangement with 2M partners.

The regular weekly capacity on the USWC sectors is expected to be 298,000 TEU by May, before adjustments for void sailings or extra loaders that carriers could implement to account for the temporary fluctuations in market demand. Comparatively, there were 305,000 TEU in 2019.

THE Alliance will add a new USWC string (PS8), accommodating six of HMM’s 8,500 TEU ships that are to be transferred from PS1, while 2M and ZIM will also launch a new TP-1/Maple/ZP8 service, expected to employ 8,600 TEU ships that will partly replace Maersk’s and MSC’s current slots on HMM’s PN2 service.

It is anticipated that the overall capacity reduction of 2.3% would not have a significant impact on the market, unless there is a significant fluctuation in demand.

Other Coronavirus Hot Spots

Conditions continue to ease in China with authorities lifting citywide lockdowns, while other countries are struggling with new infections. South Korea, Japan, Iran and France have reported a significant increase in cases recently. Italy has the most cases for Europe as of late, most concentrated in the northern party of the country. As a result, multiple airlines have cancelled flights to Seoul, Milan and Tokyo’s Narita Airports, while some carriers are continuing service to Tokyo Hanea Airport.

The United States has also had a sudden increase in cases, a majority of which are centered in Washington and California.

Sources: FreightWaves, JOC, Business Insider, Alphaliner, Mallory Alexander Asia-Pacific